Best online casino in the US

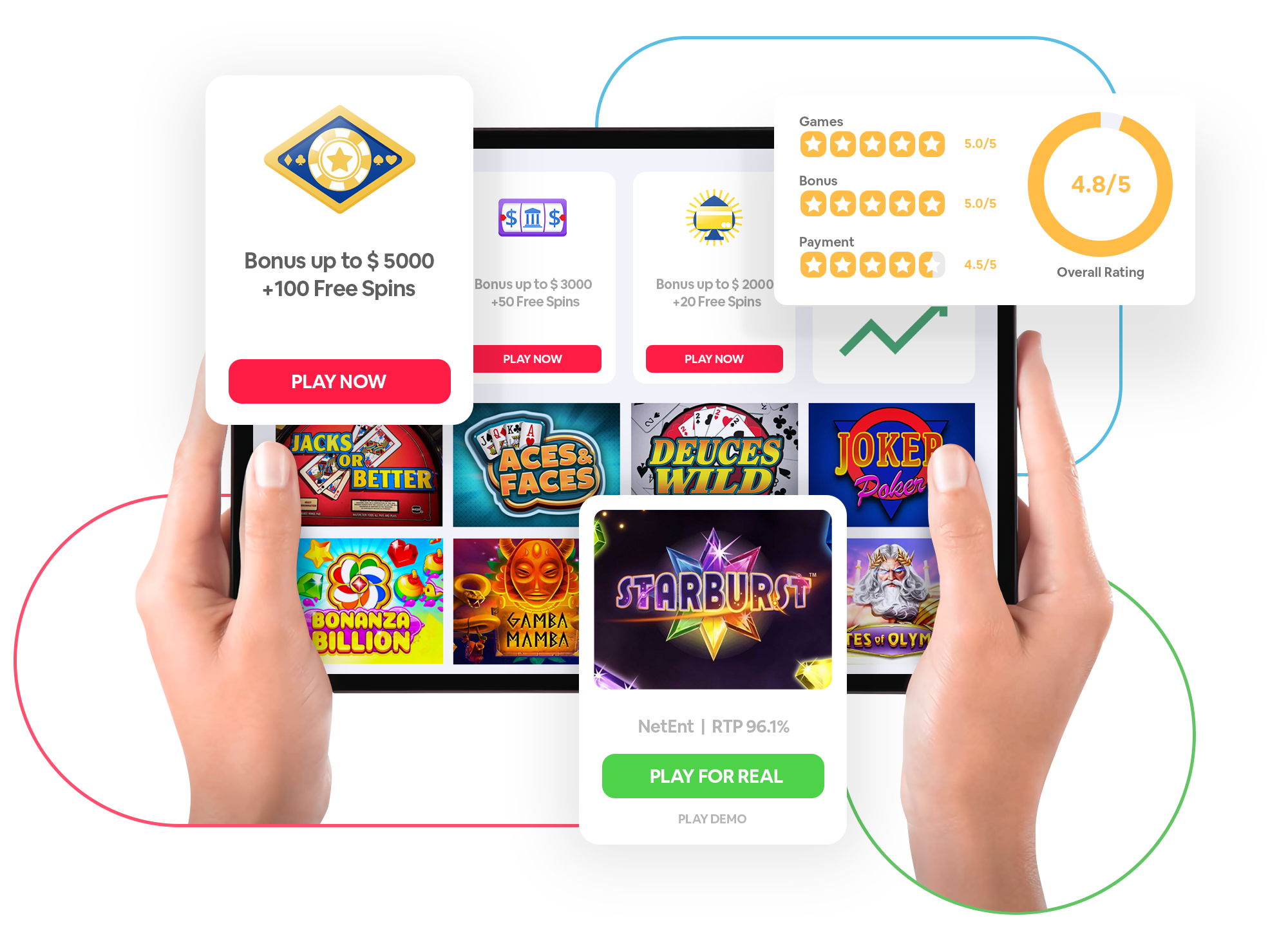

Find top US online casinos offering a mix of games, strong security, and great bonuses. These user-friendly sites are perfect for both beginners and experienced players, ensuring a safe and enjoyable gaming experience. Let’s dive in to find your ideal online casino!

1 | Up to $3,000 bonus + 30 free spins |

| Visit now |

2 | $8,888 bonuses + 350 free spins |

| Visit now |

3 | Up to $6,000 bonus + 100 free spins |

| Visit now |

4 | 300% up to $6000 welcome bonus |

| Visit now |

5 | Up to $3,000 welcome bonus |

| Visit now |

6 | Up to $12,250 welcome bonus |

| Visit now |

7 | $5,555 welcome package |

| Visit now |

8 | Up to $14,000 welcome bonus |

| Visit now |

9 | 350% welcome bonus up to $2,500 |

| Visit now |

10 | Up to $12,250 welcome bonus |

| Visit now |

How to choose the best online casino in the US

- Licensing, Fairness, and Security : Trustworthy US online casinos are recognized by their solid licensing and regulation. Choose casinos endorsed by authoritative bodies to guarantee legal operations and fair play. This ensures a secure betting environment where your funds are safe and games are just.

- Online Games & Software : The best online casinos feature games from reputable developers like Microgaming or NetEnt. These providers are known for their innovative and diverse game selections, ensuring fair and secure betting. Their adherence to regulatory standards is a testament to their reliability.

- Bonuses and Promotions : Significant welcome bonuses and ongoing promotions are crucial for real money players. Opt for casinos offering beneficial yet realistic bonuses that enhance your gaming experience and increase your chances of winning.

- Banking Options : Diverse and secure banking methods are essential. Top casinos offer a variety of deposit and withdrawal options, including credit cards, e-wallets, and bank transfers, with swift processing for hassle-free transactions.

- Mobile & User Experience : Leading real money online casinos provide a smooth mobile experience, whether through user-friendly websites or dedicated apps. An intuitive interface across devices is crucial for an uninterrupted gaming session.

- Reputation and Reviews : A casino’s reputation, discernible through player reviews and community feedback, is a vital indicator of its trustworthiness. Casinos with positive reviews are generally more reliable.

- Customer Support : Exceptional customer service is a must. Choose casinos that offer 24/7 support through live chat, email, and phone, ensuring assistance whenever needed.

- Responsible Gaming Resources : Look for casinos that promote responsible gambling with tools like self-exclusion options, deposit limits, and access to problem gambling support, fostering a safe gambling environment.

In summary, the best online casinos in the USA are those that combine security, a wide range of games, attractive bonuses, efficient banking options, excellent customer service, and a commitment to responsible gambling. Consider these factors to ensure a secure, enjoyable, and potentially lucrative online gambling experience.

Reliable and trustworthy online casinos USA: licensing, fairness, and security

In the high-stakes world of online casinos, particularly when it involves real money, prioritizing safety is essential.

When it comes to playing at online casinos, we consistently handpick the best US casinos. These are not just establishments that offer a secure gaming environment, but they also ensure the safe handling of your deposits and withdrawals. Rigorously vetted, these casinos undergo strict regulatory checks, are subject to third-party audits, and maintain a steadfast commitment to fair play.

As you evaluate the safety and security of an online casino for real money play, remember to consider these critical aspects:

- Licensing : Seek out casinos with appropriate licensing to ensure they operate under ongoing regulation and prioritize player protection.

- Audits : Regular independent audits are crucial for verifying game fairness and the security of your funds.

- Technical Security : Trustworthy casinos employ advanced security measures to safeguard your real money transactions.

- Fair Games : Ensure that games use random number generators (RNGs) and are routinely tested for fairness, a vital consideration for real money gaming.

- SHA-3 Hash Algorithm : The application of this algorithm in RNGs guarantees the integrity and fairness of real money games.

- Hybrid RSA Encryption : This advanced encryption method helps secure your real money transactions, shielding your funds from unauthorized access.

- Software : Reliable real money casinos should partner with esteemed providers and rigorously test their games for fairness, ensuring a dependable gaming experience.

- Transactions : Ensure that deposits and withdrawals are conducted through SSL encryption to protect the safety of your financial transactions.

- Ownership : Prefer casinos owned by reputable gaming groups for a more trustworthy real money gaming experience.

These criteria, when combined, help ensure that the online casinos you choose offer the best and most secure environment for your real money gaming needs.

Safety and security in USA online casinos

Online casinos in the United States operate under stringent oversight to ensure their safety and security. With each state enforcing distinct gambling laws and regulations, specialized state-specific commissions play a pivotal role in supervising online gambling activities. These commissions are critical in upholding high standards of safety and security within the online gambling industry.

Key methods employed by these commissions to ensure compliance and fairness include:

- Auditing Casino Operations : Regular audits are an integral part of maintaining the integrity of online casinos. These audits assess compliance with regulations and verify the fairness of the casino’s games and operational practices.

- Reviewing Casino Applications : The licensing process involves extensive evaluation. Regulatory bodies conduct thorough reviews of casino applications, scrutinizing their business models and financial stability to ensure a secure gaming environment for players.

- Investigating Issue Reports : Prompt action is essential in addressing reports of potential problems. Whether it’s player complaints about unfair practices or other security concerns, these investigations are swift and thorough, ensuring issues are resolved quickly. This approach is key to sustaining trust in the online gambling ecosystem.

By adhering to these rigorous standards, state-specific commissions ensure that online casinos in the United States offer a safe and secure environment for gamblers.

Expert auditors’ role

Expert auditors, such as those from eCOGRA, play a pivotal role in maintaining the integrity and trustworthiness of online casinos. Their primary responsibility is to verify the fairness and randomness of the games offered by these casinos, a crucial aspect for any player’s confidence in online gambling.

Moreover, these auditors rigorously test the casinos’ payment processes and money storage protocols. Their comprehensive assessments encompass not only the casino’s website but also its parent company, meticulously scrutinizing every aspect to identify potential issues that could affect players.

The presence of a seal of approval from a recognized casino auditor on an online casino’s website serves as a significant trust indicator for players. It assures them of the security of their funds and the confidentiality of their personal information, fostering a safe and reliable gambling environment.

Decoding the role of random number generators (RNGs)

At the heart of online casino gaming, excluding live dealer games, lies the Random Number Generator (RNG). This algorithm is pivotal in determining the outcomes of various game actions, such as spins and card draws, ensuring that every play is entirely random. RNGs are designed to replicate the natural randomness that you would experience in physical, brick-and-mortar casinos.

To uphold fairness in gaming, RNGs used in reputable online slots and other casino games undergo regular testing by independent auditors. This testing is critical to ensure the integrity and fairness of the games. When you play on sites where RNGs have been independently verified, you can be assured of engaging in secure and equitable gaming. This level of scrutiny ensures that every player has an equal chance of winning, thereby maintaining the overall integrity and trustworthiness of online gambling.

Advanced security protocols

Reliable online casinos prioritize advanced security measures to ensure the protection of players and their funds. When choosing a reputable online casino, you can expect to encounter several key security features:

- SSL (Secure Sockets Layer) : This technology establishes a secure, encrypted connection between your device and the casino, safeguarding the transmission of sensitive data.

- 2-Step Verification : An additional layer of security, often involving a unique code sent to your phone, helps prevent unauthorized access to your account.

- ID Verification : Essential for protecting against identity theft, this process confirms your identity, safeguarding both your account and the casino’s operations.

- Segregated Funds : Top-tier casinos maintain player funds separately from their operational finances, providing an added layer of financial security.

- Responsible Gaming Tools : Tools like deposit limits and self-exclusion options underscore the casino’s dedication to responsible gaming and player well-being.

We advocate for online casinos that not only prioritize your safety but also implement these robust security protocols, ensuring a secure and trustworthy gaming experience.

Popular games in best online casinos USA

Online casinos in the USA are home to a wide array of popular casino games, catering to diverse player preferences. These platforms provide access to a multitude of choices, including:

- Online slots : Known for their vibrant themes and exciting bonus features.

- Blackjack : A classic card game offering a mix of skill and luck.

- Roulette : A game of chance with various betting options.

- Video poker : Combining elements of poker and slots for a unique experience.

- Baccarat : A simple yet elegant card game favored by many.

- Craps : A dice game with a wide range of betting possibilities.

- Texas Hold’em : A popular form of poker with strategic gameplay.

A diverse selection of these games is crucial for a comprehensive online casino experience. The leading US gambling sites showcase these games, all from esteemed providers, and boast advanced graphics that replicate the thrilling Las Vegas atmosphere.

To assist you in making informed choices, we have compiled a list of these popular casino games, highlighting their lowest house edges. This provides valuable insight into the potential returns each game can offer, allowing you to strategically select games that align with your preferences and gaming style.

Best USA Online Slots

Key Highlights of Online Slot Play:

- An extensive library of high-quality games developed by trusted industry leaders, ensuring fair and secure gameplay.

- Alluring welcome bonuses tailored for high-payout slots, often featuring extra spins and impressive payout percentages.

- Reliable customer support and routine game reviews to uphold exceptional quality.

Discovering the Diversity of Online Slot Games

Online slot machines offer a rich tapestry of types, each bringing its own unique features and gameplay styles. Here’s an exploration of the various kinds of slots you’ll encounter in online casinos:

- Three-reel slots : These are the classic, time-honored slots, featuring a straightforward format where the objective is to match three symbols along a single payline.

- Five-reel slots : Celebrated for their diverse themes, these slots boast five reels and a spectrum of paylines, providing players with more opportunities to win.

- Multi-payline and multi-Reel slots : These slots present a multitude of paylines stretched across multiple reels, often incorporating engaging bonus rounds and the chance for free spins.

- Video slots : A contemporary twist on traditional slots, these themed games offer creative ways to win, including bonus features that enhance the gaming experience.

- 3D slots : Renowned for their captivating narratives and cutting-edge graphics, 3D slots immerse players in a deeper and more immersive gaming adventure.

- Progressive slots : These slots are interconnected across various platforms, pooling bets from multiple players to create colossal jackpots that can be life-changing.

- Branded slots : Drawing inspiration from popular movies, TV shows, and other media, these slots often feature well-known themes and characters. An iconic example is “Lara Croft: Tomb Raider” by Microgaming, which made its groundbreaking debut in 2004.

Each type of slot game caters to distinct player preferences, offering a unique and enjoyable gaming experience. Whether you’re a fan of classic simplicity or immersive storytelling, online slots have something for everyone.

Strategies and Tips for Online Slots: Enhancing Your Odds of Winning

Achieving success in online slots can be a thrilling challenge due to their inherent randomness. While no skill can guarantee a win, a solid understanding of slot mechanics and the implementation of smart strategies can significantly improve your chances. Slots are fundamentally games of chance, offering equal odds to every player, with gameplay revolving around spinning the reels to align symbols on paylines.

To elevate your online slot gaming experience, informed choices are the key. While you can’t alter the game’s inherent randomness, you can make strategic decisions to enhance your prospects. Here are some top tips and strategies to help you gain an edge:

- Choose the right slot : Pay close attention to each slot’s theme, soundtrack, features, and, most importantly, the Return to Player (RTP) rates. Slots with higher RTPs have the potential to provide better returns. The term ‘Return to Player’ signifies the average payout percentage, based on a minimum of 10,000 spins. For example, a slot with a 90% RTP means you may, on average, receive $90 back for every $100 wagered.

- Practice with free play : Before venturing into real-money play, explore free slot games. This allows you to grasp the nuances of each game, especially those with intricate bonus features.

- Understand the pay table : Familiarize yourself with the pay table of each slot, which outlines the value of each symbol and highlights lucrative ones like wilds and scatters.

- Stick to a budget : Establish a predetermined spending limit before commencing play, and adhere to it diligently to prevent financial pitfalls.

- Opt for smaller jackpots : Games with smaller jackpots typically yield more frequent payouts. While the allure of large progressive jackpots is undeniable, they often come with lower odds of winning.

By applying these strategies, you can enhance your enjoyment of online slots while also engaging in responsible gambling. Remember that while winning is exhilarating, responsible gaming is paramount.

Online blackjack: a classic casino favorite in the USA

Furthermore, we’ve curated a selection of popular blackjack games that we’ve personally put to the test, even coming away with a few winnings! So, let’s shuffle those cards and get started!

When delving into online blackjack, you have two paths: real money or free games. Start with free games for a risk-free training ground to learn the game, test strategies, and build confidence. It’s your personal blackjack simulator.

Transitioning to real money blackjack adds excitement, with the potential for significant wins and a dynamic gaming environment. Plus, you’ll access a wide range of games, including live dealers for an authentic Vegas experience. Begin with free games and, when ready, step into real money play. 🃏👍

Exploring blackjack variations

Are you up for some exciting twists on the classic blackjack experience? A best online casino offer a variety of captivating variations that can add a new dimension to your gaming. Here’s a quick overview:

- Blackjack surrender : Ever wished you could retreat after seeing your initial two cards? In this version, you have the option to surrender and receive half of your stake back.

- Blackjack switch : Imagine playing two hands and having the ability to swap the top cards between them. Plus, there’s a bonus side bet if your first four cards form a pair or better.

- Live blackjack : If you love the thrill of a real casino, live blackjack brings a genuine dealer to your screen, blending online convenience with the ambiance of a land-based casino.

- Atlantic city : This variation comes with distinct rules, like the dealer standing on 17 and checking for blackjack. You can also split your cards up to three times.

- European blackjack : A streamlined version using just two decks, with restrictions on doubling down. It’s all about strategic play here!

- Perfect blackjack: Here’s a twist where you can bet on getting a perfect pair – same cards, same suit. Hit it, and the payout is impressive!

Each of these games has its unique charm, offering a different flavor of blackjack. Why not give them a try and discover which one suits your style best?

Mastering blackjack: from beginner to advanced strategies

Blackjack isn’t solely a game of chance; it’s a game of strategy. Whether you’re just starting or aiming to take your skills to the next level, we’ve got you covered. From the basics to advanced techniques like Martingale and d’Alembert, we’re here to provide guidance. Learn about card values, delve into card counting, and explore effective betting strategies. While no strategy can guarantee a win, the right approach can significantly improve your odds. Are you ready to play smarter? Let’s dive right in!

Getting familiar with blackjack basics

- Objective : Beat the dealer! Aim for 21 without going over, or you’ll bust and lose your bet.

- Starting : You begin with two cards, both face up, while the dealer reveals just one.

- Variant rules : Each blackjack variation has its own set of rules, such as when to surrender or the dealer’s hit/stand decisions.

Achieving 21 : Hitting a 21 may result in a payout of 1.5 times your bet, depending on the casino’s rules.

For the pros out there or those seeking a more in-depth understanding, visit our comprehensive how-to page. Short on time? Our quick blackjack tips guide offers a speedy overview. Ready to decide whether to hit or stand? 🃏👍

Mastering blackjack card values

Understanding card values in blackjack is essential. Most are straightforward: number cards have their face value, and 10, J, Q, and K are all worth 10 points.

However, there’s a twist : Aces. They can be 1 or 11, depending on your preference. For example, an initial hand of A5 can be counted as either 6 or 16. Draw a 9, and it’s 15; draw a 3, and it’s 19. When you hold an Ace, it’s referred to as “soft” because it can adapt to your needs. Keep this valuable knowledge in your blackjack toolkit for better gameplay!

Online Roulette

- European roulette : Your top choice for favorable player odds, thanks to the absence of the double “00.”

- American roulette : The classic version featuring both “0” and “00,” offering a larger house edge.

- French roulette : No “00,” but keep an eye on unique rules like En Prison and La Partage.

- 3D roulette : Experience the game in stunning 3D graphics for a lifelike feel.

- Mini roulette : Test your luck on a smaller wheel with numbers up to 12 and a special “0” rule.

- Live dealer roulette : Get the full casino experience from the comfort of your home, competing against a live dealer through a video link.

Explore these captivating roulette variations and elevate your gaming experience to new heights.

Mastering Online Roulette: Strategies for Success

If you’re looking to elevate your online roulette game, we’ve got you covered with practical strategies:

- Rule Mastery : Start by mastering the fundamental rules of roulette to make well-informed decisions.

- Strategic Approach : Choose a roulette strategy that aligns with your gaming style and objectives.

- Free Practice : Hone your skills with free roulette games to refine your techniques before placing bets.

- Learn from Pros : Gain insights from experienced roulette players to improve your overall performance.

- Odds Understanding : Familiarize yourself with roulette odds to place strategic bets that work to your advantage.

- Select Wisely : Opt for a reputable roulette site that ensures a secure and enjoyable gaming experience.

With these strategies at your disposal, you can enhance your roulette skills and significantly boost your chances of success. Best of luck at the roulette table!

Video Pokers

Enjoy the convenience of mobile gaming and the flexibility it provides, allowing you to play on your tablet or smartphone through dedicated apps or mobile casinos. Rest assured that our recommended online casinos prioritize swift cashouts, ensuring you receive your winnings within a maximum of three days.

With a wide array of video poker variations to choose from, your gaming adventure is certain to be both thrilling and rewarding. It’s time to become a master of online video poker and pursue those real money wins. Best of luck at the tables!

Types of Video Poker

Video poker variations come with unique rules and strategies, catering to different types of players. Here’s a concise overview of each:

- Deuces Wild : This popular variation features “two point” cards (deuces) as wild, substituting for any other card. It increases the chances of winning hands, but payout rates are adjusted to compensate for this advantage.

- Double Bonus : In this variation, players aim for two bonuses, both being four of a kind. It’s known for its bonus payouts, particularly for specific four-of-a-kind hands.

- Triple Play : Triple Play allows you to play three hands simultaneously, adding extra excitement to the game. It comes in various sub-variations, including Deuces Wild, Double Double Bonus, and Draw Poker.

- Jokers Wild : This version introduces a Joker card, acting as a wild card that can replace any other card. With 53 cards in play (a standard deck plus the Joker), players have more opportunities to form winning hands.

- Double Double Bonus : Known for its high volatility, Double Double Bonus poker offers the potential for significant rewards. It introduced the concept of a “kicker” that can double your winnings when used correctly.

- Multi-Play : Multi-Play poker lets players participate in multiple hands simultaneously, with some games offering up to 50 hands at once. It’s available in both free and real money versions, allowing players to practice before wagering real cash.

Video poker playing tips

Mastering video poker requires a blend of luck and strategy, and we’re here to provide some quick tips to enhance your chances of success on your video poker journey:

- Know your variants : Video poker isn’t a one-size-fits-all game. There are numerous variants, each with its own unique rules and nuances. It’s crucial to understand the specific game you’re playing, so take the time to familiarize yourself with its rules. This knowledge will enable you to make informed decisions at the table.

- Bet the maximum coins : A golden rule for video poker success is to always play with the maximum coin bets when possible. It’s akin to getting the full value from your wagers. Additionally, high limit slots often yield more frequent payouts than their regular counterparts, so if your bankroll allows, give them a try.

- Decode the pay structures : To make intelligent decisions and effectively manage risk, it’s essential to decipher the pay structures. Different variations offer varying payouts for different hands. Understanding these pay tables will empower you to make wise choices during gameplay.

- Master bankroll management : This tip applies to all forms of gambling—manage your bankroll wisely. Never wager money that you can’t afford to lose, and resist the temptation to chase losses. By closely monitoring your bankroll, you’ll ensure that your video poker experience remains enjoyable and responsible.

Online Pokers

Online poker extends two distinct avenues for play: real money poker and free poker. In the realm of real money poker, the allure lies in the prospect of tangible cash winnings. However, this path carries elevated stakes and the inherent risk of financial losses.

Conversely, free poker offers a risk-free environment where you can refine your skills and relish the game’s intricacies. Yet, it’s important to note that there are no actual cash prizes on the line. Your choice between these two paths should align with your objectives, comfort level, and whether you seek the exhilaration of high-stakes competition or a more leisurely poker experience.

Exploring Online Poker Variations

When it comes to online poker, the possibilities are vast, and the thrill is unending. Whether you’re on your mobile device or desktop, we’ve got an impressive lineup of poker games that will keep you engaged and entertained. Here’s a sneak peek at what’s in store:

- Texas Hold’em : This poker superstar grants you two hole cards and five community cards to craft your winning hand. It’s a game of strategy and skill, accompanied by rounds of strategic betting. If you’re new to Texas Hold’em, don’t worry; we’ve got a handy guide on how to play poker to get you started.

- Five-card draw : A classic in its own right, this game challenges you to create the best hand with five cards. You even have the opportunity to swap out some of your cards for fresh ones during a draw phase. It serves as the foundation for standard video poker games you might have encountered.

- Omaha high/low : A twist on traditional Omaha poker, this variant has players utilizing two of their four hole cards and three community cards to form two distinct five-card hands—one high and one low. It introduces an added layer of complexity and strategy to the game.

- Seven-card stud : In a bygone era, Seven-Card Stud rivaled Texas Hold’em in popularity. Players are dealt seven cards and must construct the best five-card hand, featuring a mix of face-up and face-down cards.

- Razz : Bearing resemblance to Seven-Card Stud but with a twist, Razz challenges you to create the lowest hand possible. It’s a delightful variation that keeps the gameplay intriguing.

- HORSE : Consider this a poker mixtape—it combines Texas Hold’em, Omaha High/Low, Razz, Seven-Card Stud, and Seven-Card Stud High/Low Split-Eight or Better. Playing HORSE requires a serious set of poker skills.

Remember, each game has its distinct vibe and strategy, offering the potential for you to discover a new favorite. And, of course, keep your eyes peeled for those enticing bonuses — they can inject some extra excitement into your poker journey. So, go ahead, shuffle those cards, and deal yourself into the captivating world of online poker.

Bonuses and promotions

Dive into the world of USA online casino bonuses, featuring extended validity and substantial deposit matches. Discover your ideal welcome bonus today!

Understanding online casino bonuses is key to a successful gambling experience. We’ve compiled community insights to address common questions about the best casino promotions, offering you expert advice.

- Maximizing your deposit : the bonus match on your deposit can range from 50% to a whopping 200%. Opting for a higher percentage can significantly enhance, match, or even double your initial deposit.

- Reading the fine print : always scrutinize the terms and conditions. The ideal time to understand the specifics of your deal is prior to accepting it. This ensures you’re fully informed of any additional stipulations.

Understanding Wagering Requirements : Wagering requirements vary from site to site. It’s essential to know how many real money wagers are necessary to unlock the option to withdraw your bonus funds from the casino. - Maximizing bonus value : the best online casino bonuses go beyond cash amounts, offering extras such as free slot spins and other enticing perks. Make the most of these opportunities to fully capitalize on the value of your bonus.

Types of casino bonuses and promotions

The world of online casinos in the USA is brimming with various types of bonuses and promotions, each designed to enhance your gaming experience. From welcome bonuses to game-specific perks, these offerings cater to different preferences and playing styles.

Understanding these various options is key to maximizing your online gambling adventures. Here’s a breakdown of the most popular types of casino bonuses and promotions available in the USA.

- Welcome bonuses : a hit among new US players, often awarded for merely signing up. These bonuses come with certain conditions, such as wagering requirements or eligibility for specific games. The benefits are substantial, including a cash reward upon registration, and a deposit match up to 200%, kick-starting your gaming with a hefty bankroll.

- No deposit bonuses : perfect for sampling casinos risk-free, as they require no initial deposit. These bonuses let you play and get a feel for games before you commit any money, with the option to withdraw the bonus after meeting playthrough requirements.

- Monthly bonuses & promotions : cater to both new and loyal players. These can include free spins and bonus cash. Regular play is often rewarded with cash prizes and other perks, keeping the gaming experience fresh and rewarding.

- High roller bonuses : designed for players who make large, regular deposits. They feature exclusive bonuses and enhanced rewards, including premium prizes like gadgets and vacations. For more detailed information, players are encouraged to visit the VIP page.

- Game-specific bonuses : attached to particular games, usually new or featured titles. These bonuses can offer extra play money, VIP points, and free spins, aiding in broadening both your gaming skills and bankroll.

- Mobile bonuses : tailored for those who play on smartphones and tablets. These include special incentives for downloading and using a casino app, allowing players to enjoy the full range of the casino’s rewards on the go.

- State-specific bonuses : unique to different US states. Online casinos in Michigan, New Jersey, Pennsylvania, and West Virginia, for example, offer bespoke bonuses, catering to the preferences of players in each region.

Casino bonus terms & conditions

Before diving into an online casino bonus, it’s crucial to thoroughly review the terms and conditions. Emphasizing the importance of understanding the T&Cs cannot be overstated. Here are key aspects you should clarify:

- Minimum deposit requirements : Identify what the minimum deposit is to qualify for the bonus.

- Time limits on bonus use : Check if there are any time constraints for using the bonus funds.

- Promo code requirements : Determine whether you need to enter any promo codes.

- Eligible games : Understand which games are included in the bonus offer.

Paying attention to details such as wagering requirements, deposit conditions, and which games contribute towards meeting these requirements will maximize your benefits from a welcome offer and help you secure the best casino bonus possible.

Online casinos to avoid in the USA

When it comes to online casinos in the USA, not all are created equal. While there are many reputable and trustworthy options, there are also some casinos you should steer clear of. To help you make informed decisions and protect your hard-earned money, here’s a guide on online casinos to avoid in the USA:

- Lack of licensing and regulation : avoid online casinos that operate without a valid license or regulatory oversight. Reputable casinos are licensed by recognized authorities, and their operations are regularly audited for fairness and security.

- Poor user reviews and ratings : before signing up at an online casino, do your research. Read user reviews and check ratings on trusted review sites. If a casino has a history of unresolved complaints, it’s a red flag.

- Unclear terms and conditions : beware of online casinos with convoluted or unclear terms and conditions. Legitimate casinos have transparent rules, especially regarding bonuses, withdrawals, and account closures.

- Delayed or non-payment : stay away from casinos that delay or refuse to pay out winnings. Reliable casinos process withdrawals promptly and without unnecessary delays.

- Lack of customer support : online casinos without responsive and helpful customer support should be avoided. You’ll want assistance if you encounter issues or have questions about your account.

- Inadequate security measures : Your safety is paramount. Avoid casinos that lack proper encryption and security protocols. Look for SSL certificates and other security features to protect your personal and financial information.

- Dishonest advertising : Be cautious of casinos that make unrealistic promises or use deceptive advertising to lure players. If it sounds too good to be true, it probably is.

- Limited game selection : A diverse game portfolio is a sign of a reputable casino. Avoid those with a limited selection of games, as they may lack quality and variety.

- Unresponsive mobile experience : In the modern era, online casinos should offer a seamless mobile experience. If the casino’s website or app is glitchy or unresponsive on mobile devices, consider other options.

- No responsible gambling resources : Legitimate online casinos prioritize responsible gambling and provide resources for players to manage their gaming habits. Avoid those that neglect this aspect.

By following these guidelines and conducting thorough research, you can steer clear of online casinos that may not have your best interests at heart. Prioritize your safety, security, and enjoyment when choosing an online casino in the USA.

Responsible online casino gaming in the USA

Engaging in online casino gaming within the USA can be a thrilling pastime, but it’s essential to approach it with responsibility at the forefront. The key to a safe and enjoyable gaming experience lies in setting clear boundaries. Only wager an amount that you can comfortably afford to lose, and resist the temptation to chase your losses. Taking regular breaks is a valuable practice to strike a healthy balance between gaming and other aspects of life.

To make informed choices, take the time to acquaint yourself with the games and their inherent risks. Avoid making impulsive bets when your emotions are running high, as this can lead to unwise decisions. Staying vigilant during gameplay also involves maintaining a sober state of mind to ensure a rational perspective.

Recognizing the warning signs of problem gambling is crucial. Keep an eye out for behaviors such as becoming overly absorbed in gambling, increasing bets purely for the thrill, or finding it challenging to curtail your gambling activities.

If you or someone you know exhibits these signs, seeking help is imperative. Fortunately, the USA offers a wealth of resources, including addiction programs, hotlines, counseling services, and support groups. By playing responsibly, you can ensure a safe and enjoyable gaming experience.

Getting help for gambling addiction in the USA

Confronting gambling addiction in the USA can be a daunting journey, but you’re not alone, and there’s a wide array of support available to assist you in your recovery. From group sessions to personalized counseling and comprehensive therapy programs, there are various avenues for seeking help.

Consider reaching out to Gamblers Anonymous, a global support network that offers a robust 12-step program designed to guide individuals on their path to recovery. They also extend their support to family members with Gam-Anon and to the children of gambling addicts with Gam-A-Teen.

The National Council on Problem Gambling, based in the USA, is dedicated to addressing gambling-related issues. They provide a plethora of resources and information on addiction, as well as guidance on available treatment options. Their network of professional counselors spans the country, offering tailored assistance.

Additionally, the Substance Abuse and Mental Health Services Administration (SAMHSA) is a valuable resource for comprehensive mental health support in the USA. SAMHSA offers a range of services, including support for gambling addiction, with helplines available 24/7 to provide confidential and compassionate assistance.

With these readily accessible resources, you can access the information, support, and treatment necessary to overcome the challenges associated with gambling addiction in the USA.